New era in corporate sustainability reporting

A new era in corporate sustainability reporting in Europe began on Monday, July 31, 2023, when the European Commission adopted the first set of European Sustainability Reporting Standards (ESRS) making sustainability reporting mandatory for a large group of companies. Less than a year after the Corporate Sustainability Reporting Directive (CSRD) entered into force on January 5, 2023, and less than 4 years after the European Commission presented the European Green Deal, the long-awaited standard is now a reality, and companies from the manufacturing to financial and insurance sectors are feverishly preparing for the big start.

The European sustainability reporting initiative is part of the effort for more transparency in company operations and their impact on people and the environment, which will help all stakeholders, including investors, civil society organizations, and consumers, to assess companies’ sustainability performance. These standards have to ensure more structured, transparent, and comparable sustainability reports and to create a solid basis for investors and financial institutions to make more informed financial decisions.

In a statement, the European Commission has confirmed that the new standards “take account of discussions with the International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI) in order to ensure a very high degree of interoperability between EU and global standards”. This way, companies can avoid double reporting and save time and effort to disclose to multiple institutions.

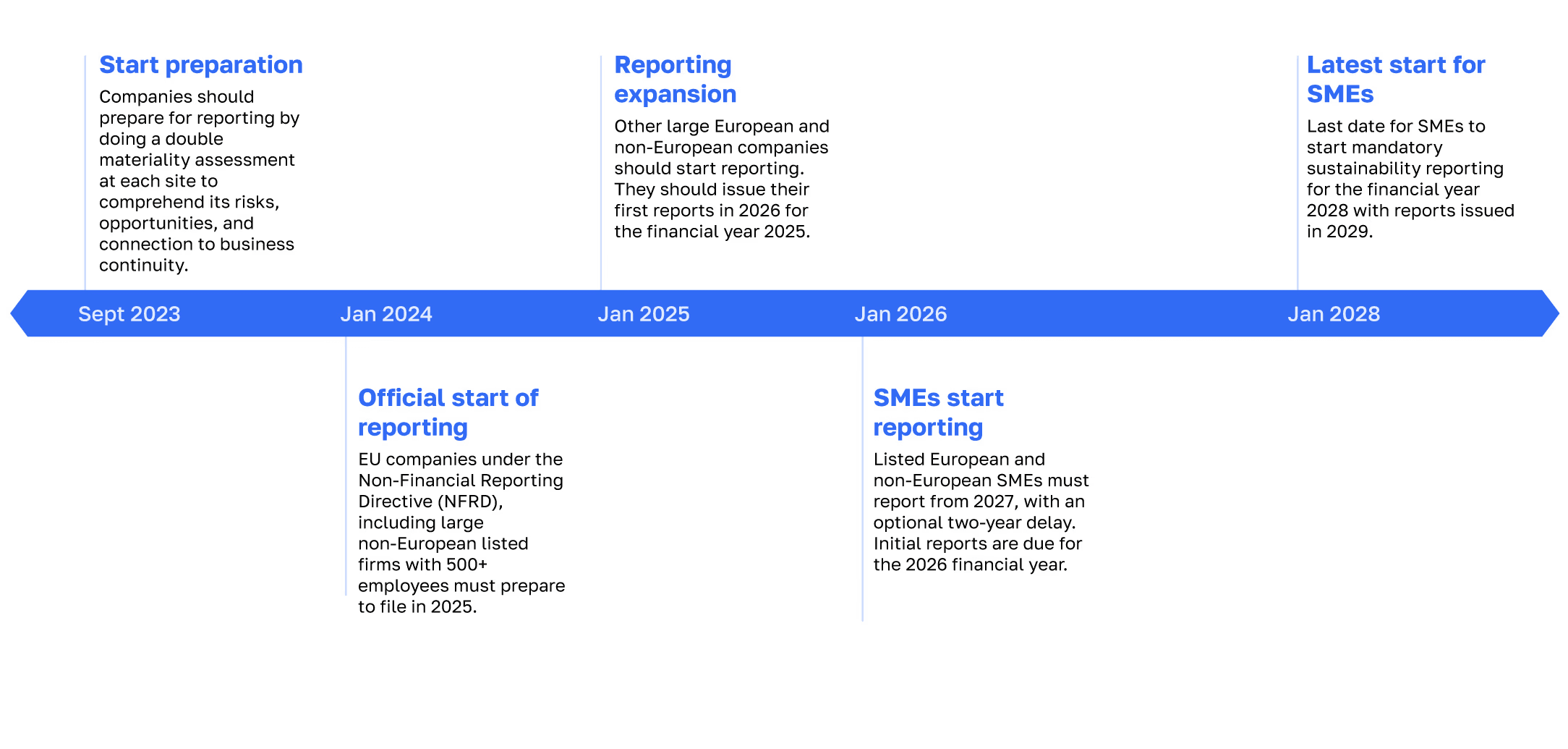

Who has to report and when?

Where does water fit?

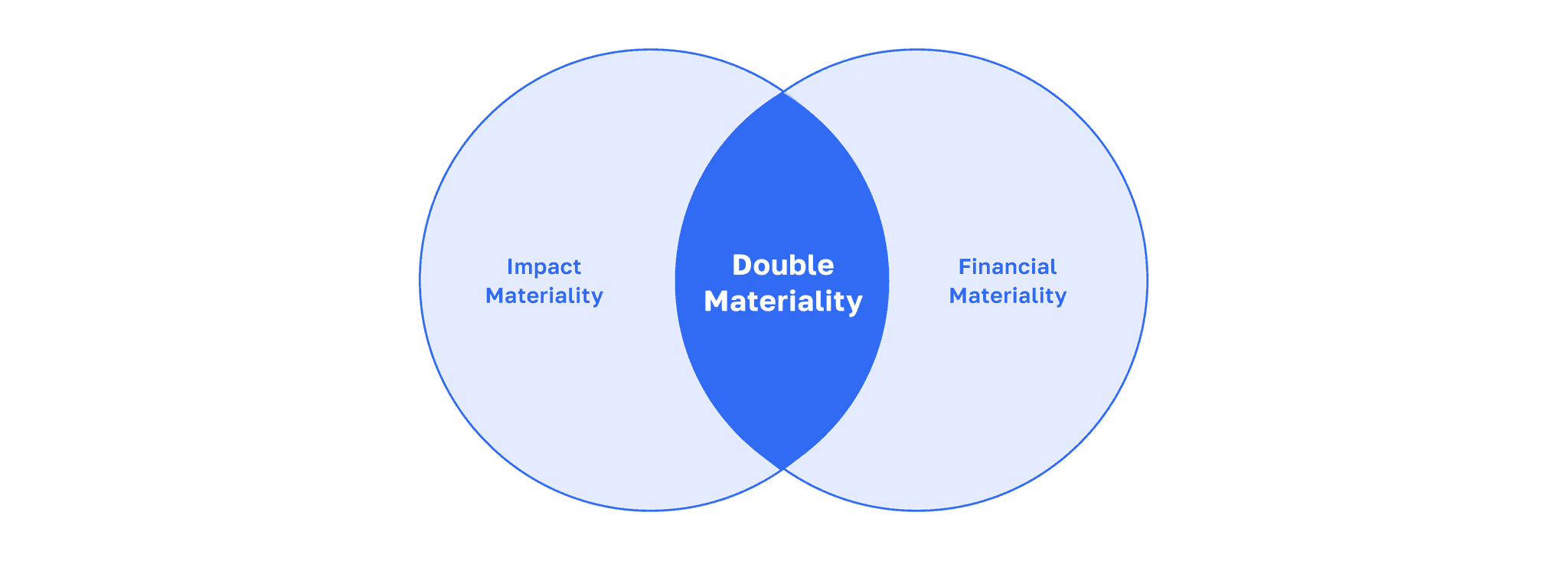

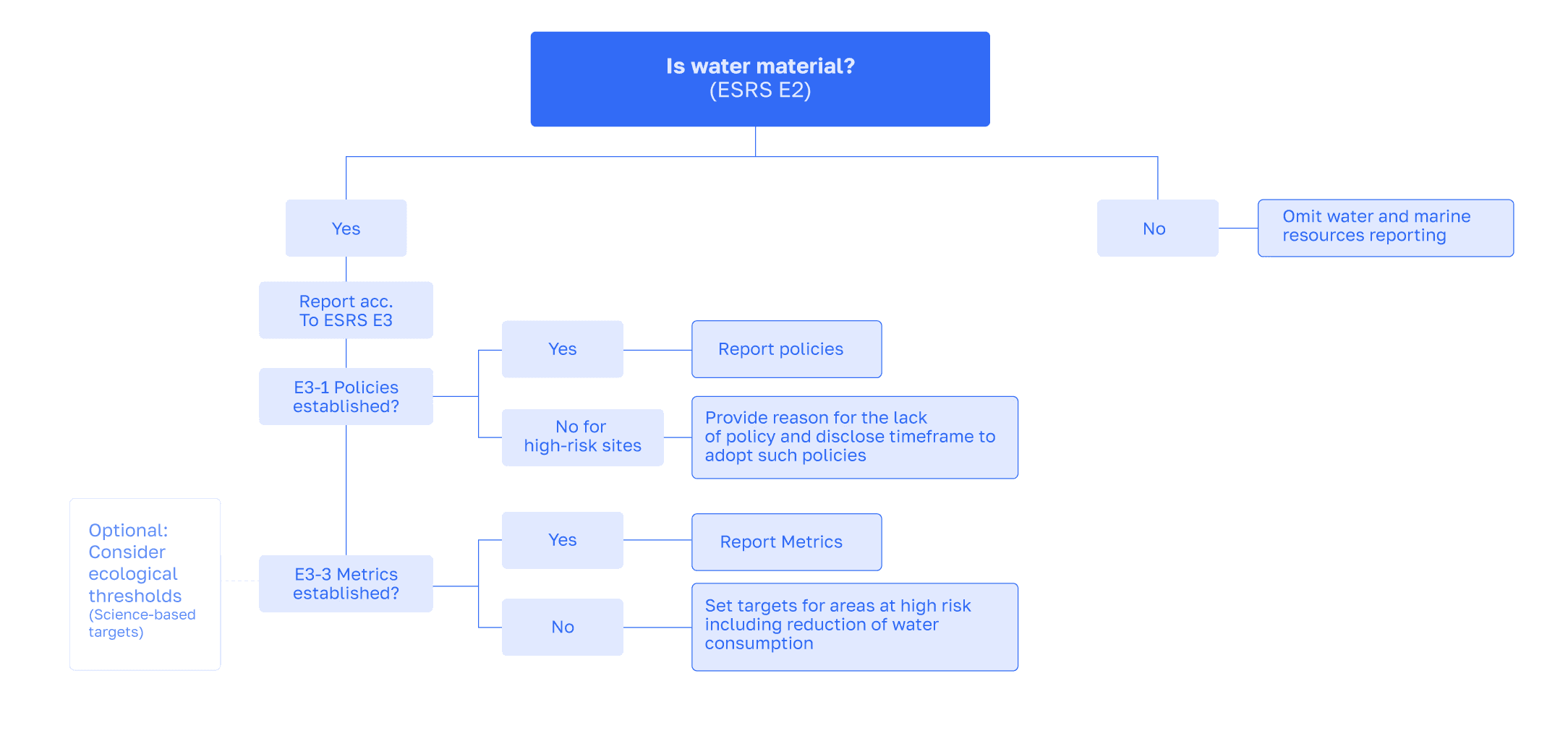

Water is subject to a double materiality assessment. This means companies will have to assess whether:

Water has a material impact on their operations and value chain

Their operations have a material impact on the local watershed as part of the ESRS E2 General Disclosure

The same logic applies to financial materiality, the second dimension of the materiality assessment. Once a company establishes that water is material for their operations, the company should report according to ESRS E3 Water and Marine Resources.

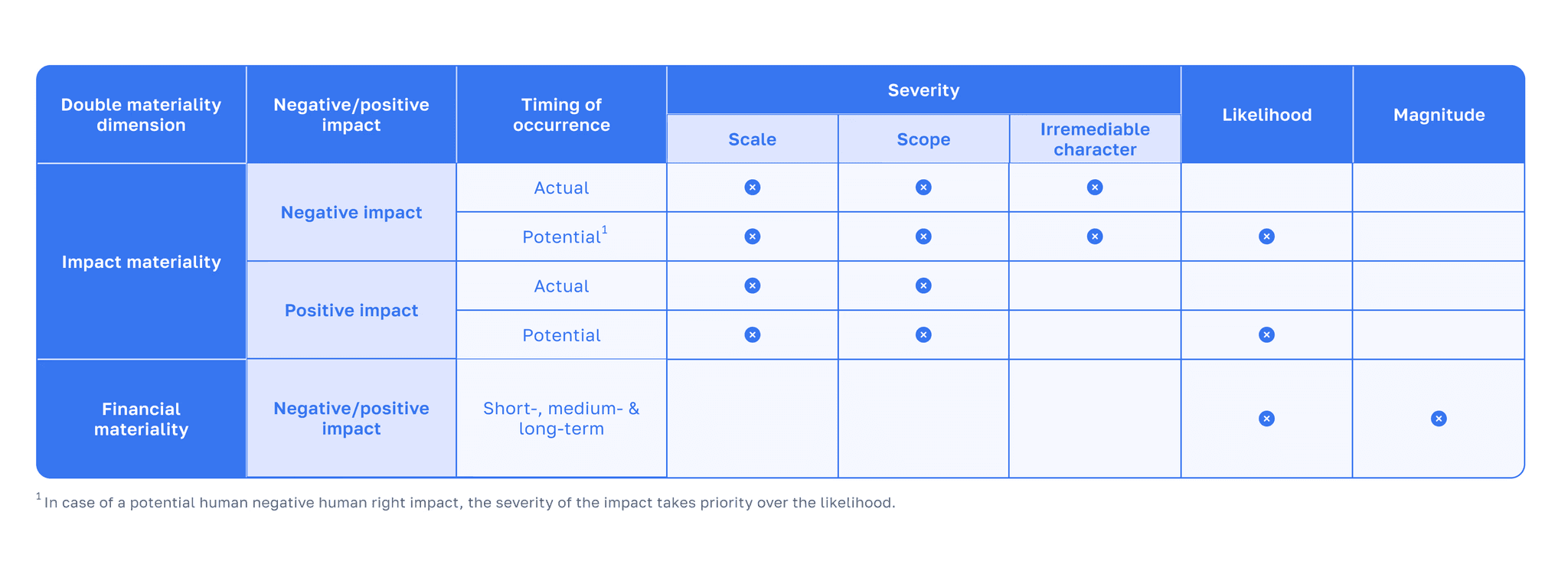

When assessing whether a given impact should be deemed material or not, companies should adopt appropriate thresholds, however, there is no guidance as to what these thresholds should be. Thus, the reporting companies and their consultants are left to decide for themselves what thresholds to choose, which could create challenges for investors to understand and compare the sustainability disclosures of different companies. ESRS E2 General Disclosure does, however, outline the characteristics of impact and financial materiality to be considered.

Beyond assessing their direct operations for water materiality, companies should also look into their value chain. Due to the difficulties in obtaining this information, value chain information is not mandatory in the first 3 years of reporting but companies will have to demonstrate efforts in obtaining this data.

How to report on water?

Water and marine resource reporting begins with risk screening in a company's operations and value chain, aligned with ESRS E2 materiality assessment, and involves community consultations. For this, a company has to assess risks and opportunities on a watershed level for each of its sites by considering local hydrological and ecological thresholds, e.g., available surface and groundwater, water quality, and water demand from other parties, and also reach out to local stakeholders affected by their water consumption. Thus, a company should create a holistic assessment of each watershed and how the company’s facility in this watershed interacts with the various stakeholders there.

As a next step required in ESRS E3-1, a company should look into its policies in place to manage the water-related risks and opportunities discovered in the materiality assessment. This includes water management policies, such as the use and sourcing of raw water and water treatment procedures but also policies about how the company is rethinking its products and services with the goal of addressing local water-related issues. This is related to a commitment to reduce the overall water consumption of sites in high-risk areas. It is important to note that any water-related commitment, especially one about the reduction of water consumption, should be based on the local context within a specific watershed in order for it to have a meaningful and long-lasting impact. Developing water-related policies requires knowledge about:

Flood exposure of facilities

Drought situations

Water availability in a specific watershed

Water quality conditions of water bodies where the company sources water, which are also discharge points for the company

New water regulations on a local or national level

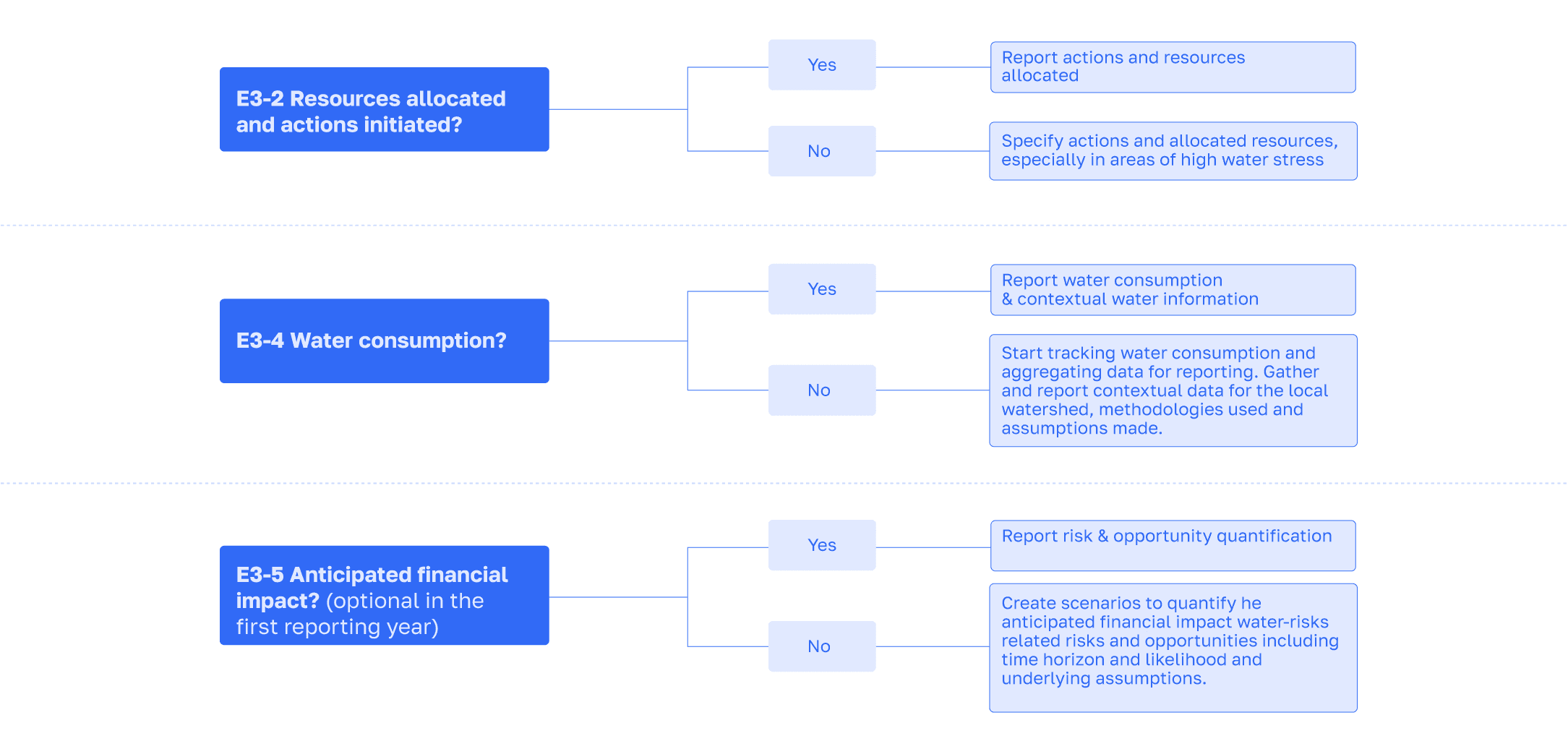

The E3-2 then goes into detail about how the company will achieve its water-related commitments by requesting data on allocated resources for avoiding or reducing the water and marine resources used through the implementation of water efficiency and recycling measures, reclaiming water, and restoring water bodies and aquatic systems. Precise project definition, which will address the risks and opportunities within the watershed, is crucial for any water-related commitments as the company has the opportunity to enhance the site’s long-term water security. At the same time, it will improve the conditions in the local watershed, thus ensuring its business continuity and fostering a deep relationship with the local community, which will improve the company’s reputation.

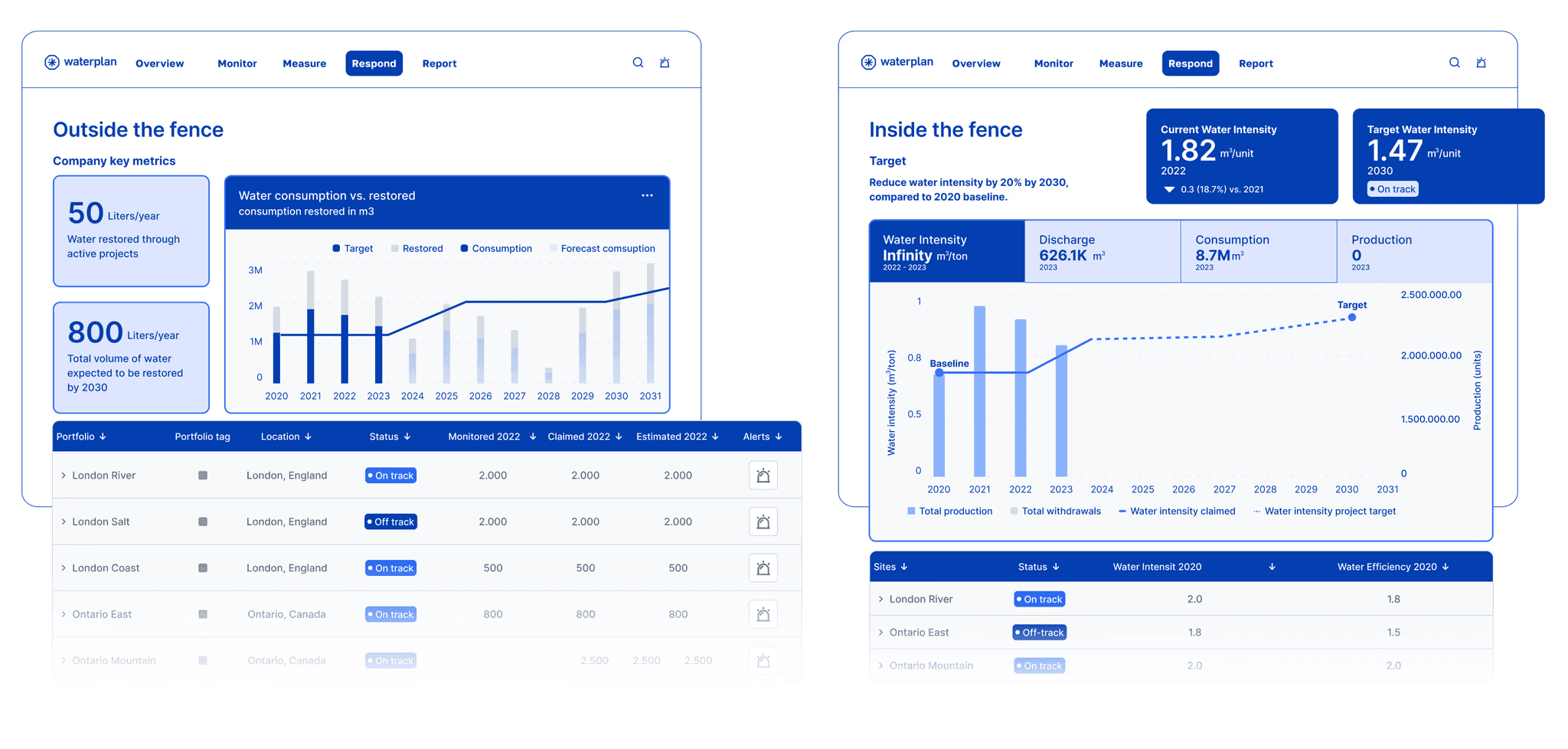

Monitoring the performance of such water-related projects across multiple sites, both inside and outside-the-fence, is a complicated task that is best achieved by utilizing a centralized solution to increase visibility and transparency of investment flows and time to completion. This is especially critical for water stewardship endeavors, such as volumetric water benefit projects, where estimations for replenished water have been traditionally done manually via spreadsheets. However, this approach is inadequate for yearly recurring reporting efforts, which require precise estimation, ongoing monitoring, and actual precipitation data.

Setting clear water-related targets (E3-3) and reporting them through suitable KPIs requires ongoing monitoring of all aspects of water management on-site. A company may choose to set context-based water targets, for which a watershed-level risk assessment and an in-depth understanding of the local water conditions is a precondition. In any case, contextual water-related information for the local watershed is to be reported as part of E3-4, along with water consumption and water intensity.

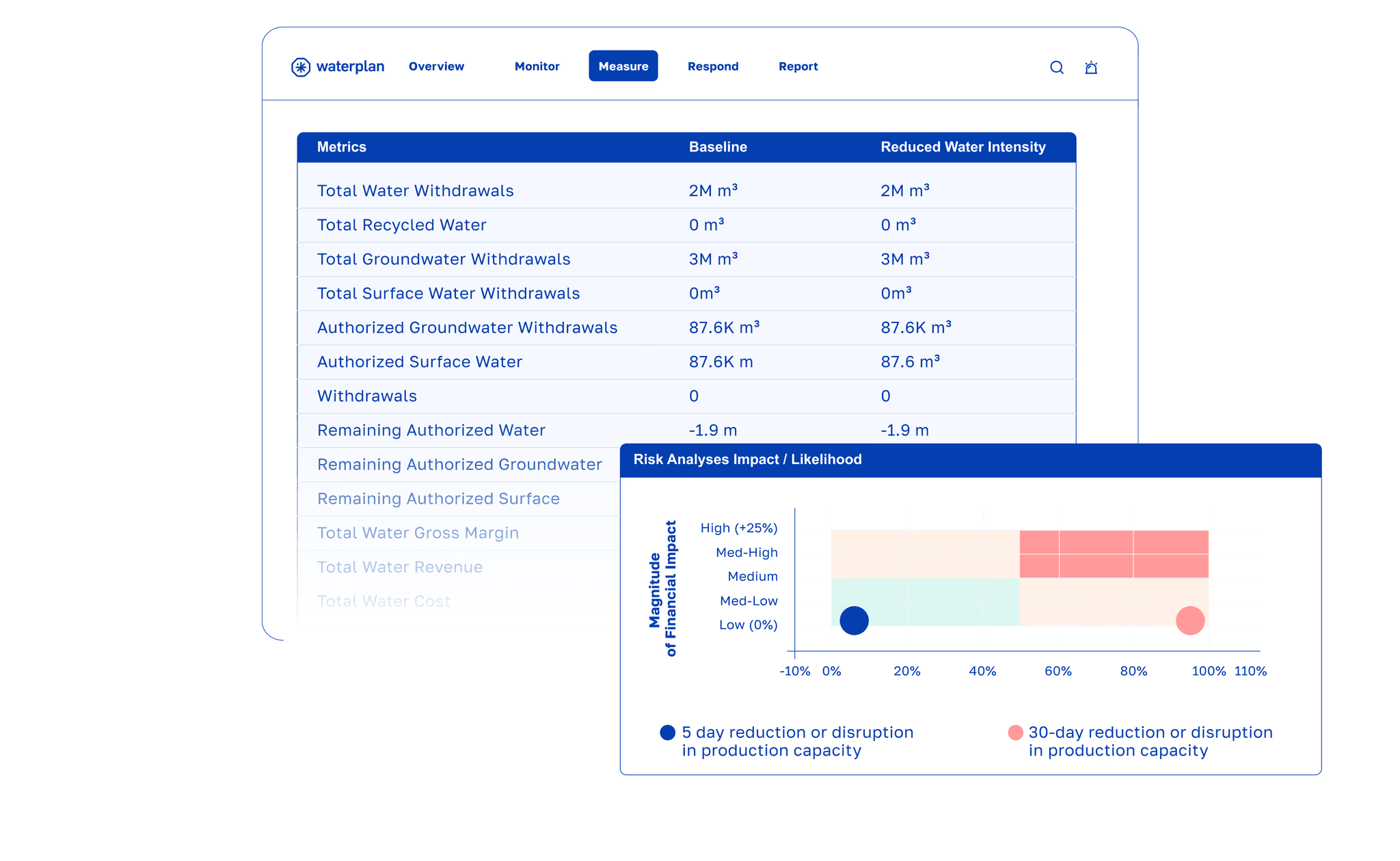

The most challenging part of the water and marine resources reporting is E3-5, the anticipated financial effects. All of the data required in the previous disclosure points is necessary to provide a reliable quantification of the water risks and opportunities. Companies have to build business cases based on facility and watershed data to demonstrate how water risks could affect a company’s financial performance through the local impact on one of its facilities. These “what-if” cases show, for example, how significantly a facility’s operations could be impacted by a 100-year flood event in case the facility is located in a high-risk zone and what impact would such an event have on a company’s production and revenue. Similarly, a facility might be impacted by a new regulation restricting water consumption in a certain watershed by 20% for a period of three months, which will reduce the facility’s output and the overall revenue of the company.

While challenging and reliant on various assumptions, this aspect of the ESRS E3 holds the most significance for reporting companies. It empowers them to grasp the actual worth of water-related concerns within the watershed and assigns a quantifiable value to associated risks. This, in turn, enables unlocking investments to initiate effective risk mitigation strategies. In places with low or no water costs, companies often overlook local water issues until regulations increase costs or impose consumption reductions. This is when water risks become financially impactful. Moreover, thorough due diligence, including environmental accountability, is a corporate responsibility, as outlined in the European Commission's upcoming Directive on Corporate Sustainability Due Diligence (currently under review).

Given the rising challenges of water scarcity, floods, and resource depletion, integrating water risk scenario analysis into overall risk management is a smart move for businesses on a continent facing these issues. While there's an option to skip disclosure in the initial reporting year (per E3-5), it's advisable not to do so. Developing these scenarios provides valuable insights that can strengthen a company's operations, making it a strategic advantage.

How can Waterplan offer support for water sustainability reporting according to ESRS E3?

Open-source water risk assessment tools available on the market can offer only an initial screening of the water risks without connecting the watershed risks to a company’s operations. It is often difficult to interpret the results and prioritize sites for setting targets and developing projects based on this high-level information. In addition to that, water accounting data is scattered across multiple sources and often not gathered in a centralized database so that global teams lack an overview of the sites’ water management. Under these circumstances, it is very challenging and resource-intensive for sustainability teams to create business cases related to water issues, thus water-related risks remain unaddressed, posing a threat to business continuity.

On the other hand, companies with water targets who invest in volumetric water benefit (VWB) projects, often rely on the services of costly consultancy companies to conduct VWB project estimation using historical precipitation data. This could lead to inaccuracies in claimed volumetric water benefits and even accusations of greenwashing.

Here’s how Waterplan can address the core requirements of ESRS:

Double materiality assessment

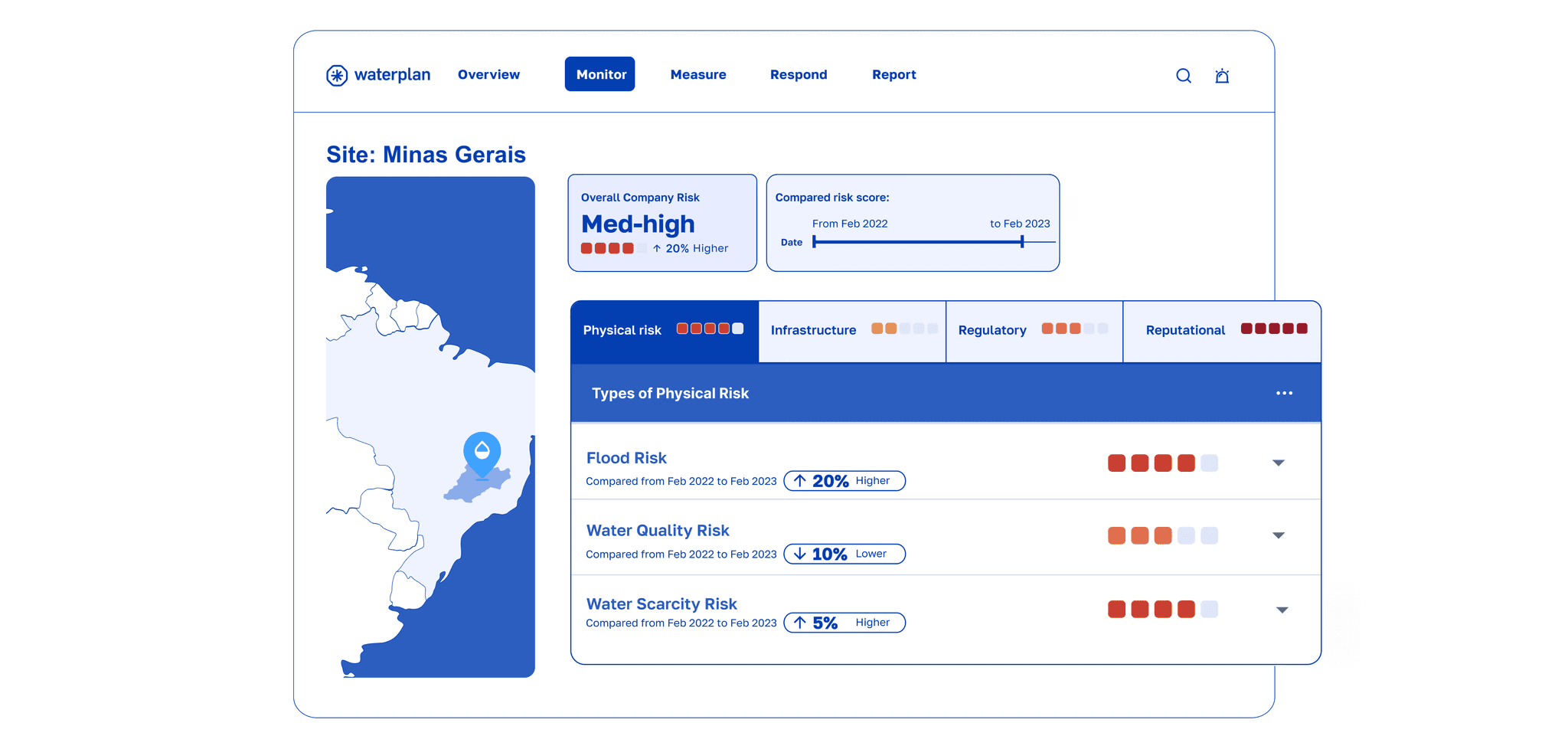

Waterplan conducts water risk analysis on a watershed level so that companies can monitor their water risks on a centralized platform using the Waterplan Risk Framework, a set of science-based indicators derived from satellite data and global datasets to monitor physical risks (scarcity, quality, and flood), infrastructure risks, regulatory risks, and reputational risks. Unlike other water risk tools, Waterplan gathers and analyzes local watershed data from various publicly available sources, such as basin management plans, water allocation plans, and regulations.

Water policies

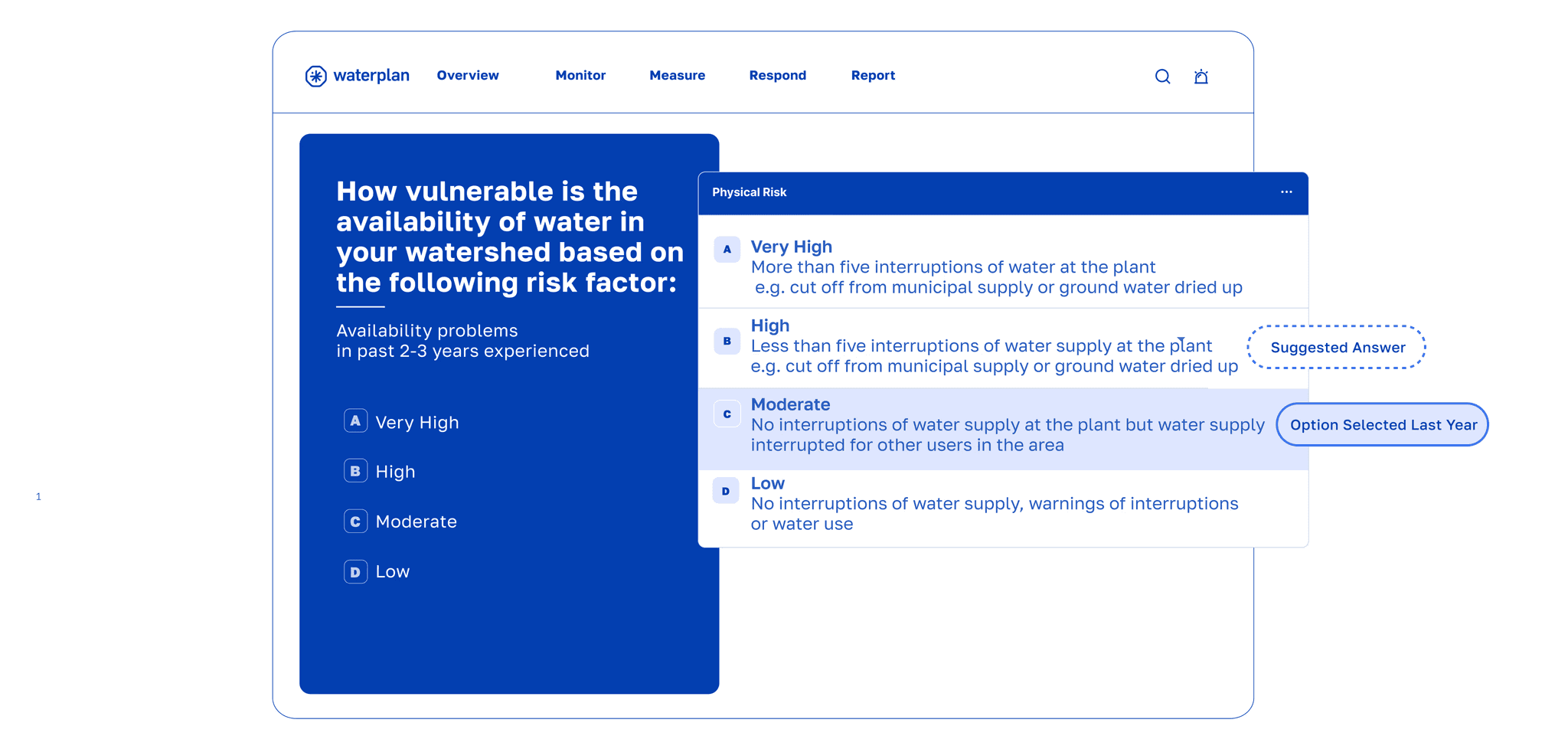

Through a self-assessment of a facility’s risk exposure and vulnerabilities, Waterplan matches existing water policies to a facility’s water risks to locate gaps in the company’s water management and supports companies in developing new water policies.

Water consumption

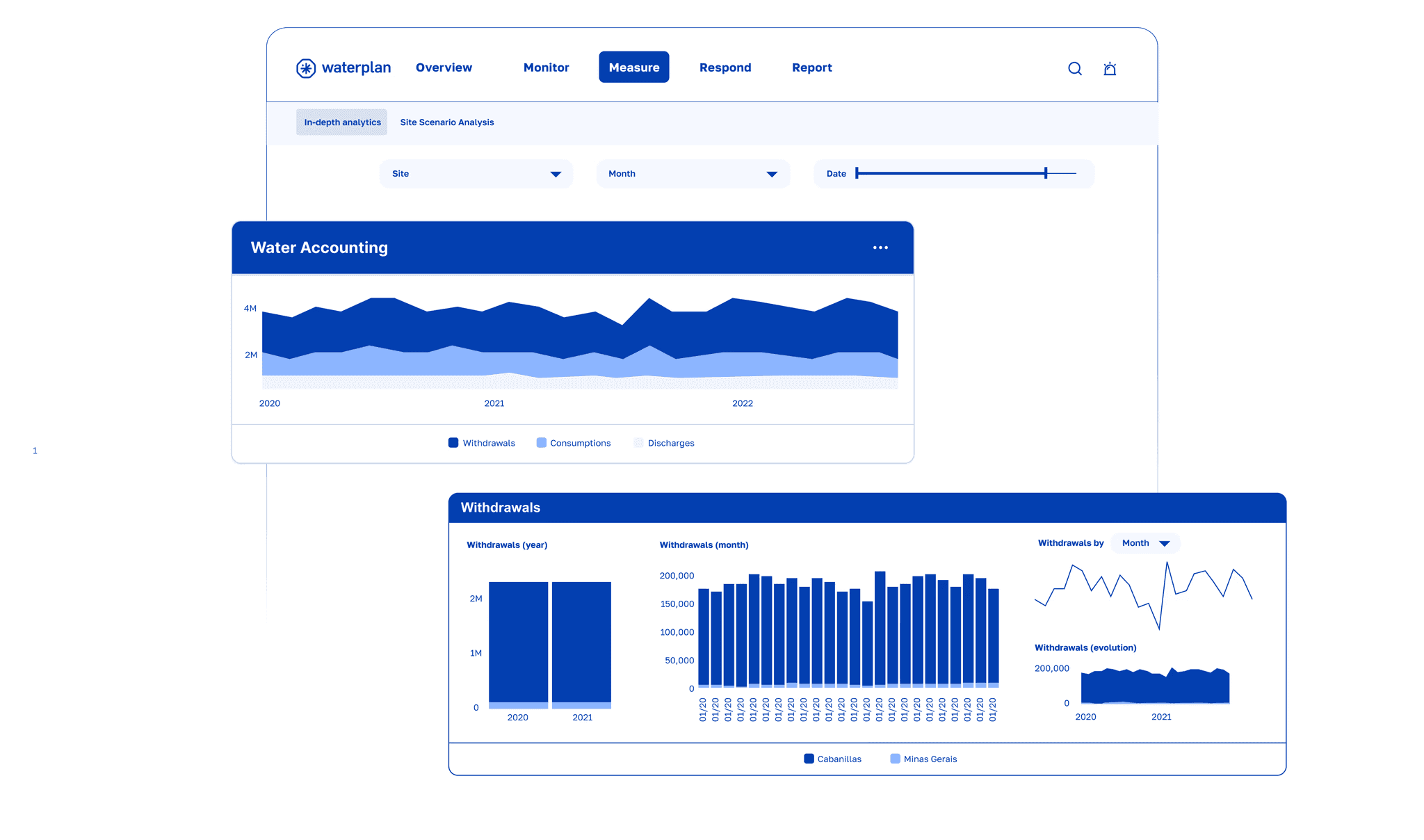

The Waterplan platform offers the opportunity for centralized monitoring of water accounting data with fully customizable dashboards where companies can add their water-related KPIs to be tracked all year long until the next reporting cycle ensuring coherency of data.

Inside and outside-the-fence projects

Companies can track their inside-the-fence and outside-the-fence projects' performance on the Waterplan platform and ensure that their investments will address and mitigate the risks for the company both in their own operations (i.e. reduce water consumption by increasing water recycling and water efficiency) and in the watershed (i.e. water replenishment of an over-extracted aquifer)

Water targets

Waterplan supports companies in setting their water targets based on contextual watershed data and tracking their performance to meet publicly communicated targets and reduce reputational risk for the company from unfulfilled public commitments.

Scenario analysis

The Scenario Analysis Builder is a tool for companies to create scenarios, estimate potential negative impacts on their businesses, and build business cases to unlock investments. Companies can adjust risk likelihood based on their risk appetite and estimate Value at Risk and Financial Impact.

To sum up, water and marine resources reporting is a complex assignment involving an extensive amount of work to be done before starting the reporting, the use of methodologies companies are not familiar with, and the development of new protocols for information flows within companies. Considering the fact that many companies have not done this before, the right partner and the right tools to reach the final goal are critical to business success and continuity.

Related content

Get insights, expert analysis and tips on measuring, reporting, and responding to water risk